Dubai continues to be one of the most attractive destinations for real estate investors, and it’s easy to see why. With no income tax, a strong expat population, and world-class infrastructure, the city offers plenty of opportunities for solid returns. In 2025, the demand for rental properties is expected to stay strong – especially in areas that offer the best Dubai rental yields.

If you’re looking to grow your property investment in Dubai, choosing the right location is key. Here’s a look at the top areas and developments that are expected to deliver high rental returns and long-term value in the year ahead.

Dubai Hills Estate – Parkwood & Hillsedge

Dubai Hills Estate by Emaar is already a favorite among investors, and in 2025, that doesn’t look like it’s changing. Parkwood and Hillsedge offer luxury living surrounded by green spaces and a championship golf course. The area is well-connected and full of amenities that appeal to families and professionals alike. With average Dubai rental yields of 6–7%, it remains one of the most reliable choices for long-term returns.

Emaar South – Golf Verge

Emaar South’s Golf Verge development is a smart pick for investors looking to tap into an area with steady growth. Overlooking an 18-hole golf course, these modern apartments offer a great mix of lifestyle and value. In 2024, the average property price here increased by 7%, while rental demand jumped 9%. That momentum is expected to continue in 2025, making Golf Verge a strong bet for anyone focused on property investment in Dubai.

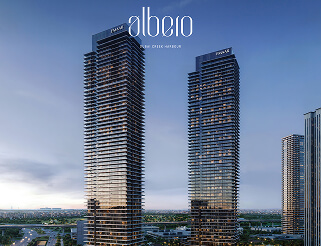

Dubai Creek Harbour – Albero

With its waterfront views and skyline backdrop, Dubai Creek Harbour is fast becoming a prime spot for investors. Albero by Emaar is part of this growing community that blends urban living with natural surroundings. As one of the newer developments in the area, it offers strong upside potential. Not just in property value, but also in future rental income.

W Residences at Dubai Harbour

W Residences at Dubai Harbour, developed by Arada, brings a new level of luxury to the market. Scheduled for completion in 2027, this triple-tower project will feature apartments, duplexes, penthouses, and even presidential suites. The location alone – right by the waterfront makes it a magnet for premium tenants. Rental yields are expected to fall in the 5–8% range, depending on unit type and size.

Armani Beach Residences – Palm Jumeirah

If you’re after exclusivity, Armani Beach Residences could be your answer. Set on the prestigious Palm Jumeirah, this project is designed for ultra-luxury living. While the entry price is high, the rental yields – especially on 2- and 3-bedroom units are projected to be around 5–6%. Given its beachfront access and brand appeal, it’s a prime choice for investors focused on high-end Dubai rental yields.

Hartland II – Villas, Skyscape Towers, and Riverside Crescent

Sobha Realty’s Hartland II is a major new community offering a mix of villas, mansions, and high-rise towers like Skyscape and Riverside Crescent (310 & 320). With landscaped surroundings, waterfront views, and modern infrastructure, it’s designed to attract long-term tenants. Investors here can benefit from growing demand for family-friendly housing in central Dubai—especially in premium, well-designed communities like this one.

The Oasis – Palace Villas (Ostra)

Palace Villas, part of Emaar’s “The Oasis” project, are tailor-made for luxury villa buyers looking for excellent capital appreciation and rental returns. Set in a private, waterfront location, this development is expected to outperform other villa markets in terms of income potential. Villas here could earn up to 20–25% more rental income than similar homes in other districts.

Vela Viento

Vela Viento stands out for its bold design and peaceful atmosphere. While yield estimates are still emerging, the development’s location and aesthetic appeal suggest strong interest from tenants seeking a premium lifestyle – especially professionals and couples who prioritize design, location, and quality of life.

The Alba Furnished Residences – Palm Jumeirah

Omniyat’s Alba Residences offer turnkey luxury living in Palm Jumeirah. These fully furnished homes are ideal for expats and professionals who want a ready-to-move-in option in a prestigious location. Expected yields range between 5–7% annually, with the added bonus of high demand for short- and long-term leases.

Element & SeaHaven

Both Element and SeaHaven are waterfront projects by Sobha Realty. Known for their focus on quality and sustainability, these developments are expected to draw strong interest from tenants who value calm, well-planned communities. While rental yield data is still evolving, the overall outlook is positive due to their location, developer reputation, and lifestyle offerings.

Final Thoughts

As 2025 unfolds, the Dubai property market is offering investors a variety of strong options – whether you’re looking for luxury, affordability, or long-term capital growth. From family-oriented communities like Dubai Hills Estate and Hartland II to upscale addresses like Armani Beach and W Residences, there’s a wide range of opportunities to explore.

Focusing on locations with proven tenant demand and reputable developers like Emaar, Sobha Realty, Arada, and Omniyat will help maximize both Dubai rental yields and resale value. With careful planning, your next property investment in Dubai could bring consistent returns and long-term growth.

References

- Inside Realty – Emaar South Golf Verge

- Totality Estates – W Residences Dubai Harbour

- Fahad Al Kuwari – Armani Beach Residences

- OPR – Palace Villas by Emaar

- iOffplan Dubai – The Alba Residences

- Offplan Search – Dubai Creek Harbour